Business Insurance in and around Hazard

Hazard! Look no further for small business insurance.

This small business insurance is not risky

- Hazard

- Hyden

- Hindman

- Whitesburg

- Jackson

- Manchester

- Salyersville

- Campton

- Jenkins

- Buckhorn

- Vicco

- Viper

- Booneville

- Beattyville

- Perry County

- Knott County

- Breathitt County

- Leslie County

- Letcher County

- Clay County

- Owsley County

- Magoffin County

Help Prepare Your Business For The Unexpected.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all on your own. As someone who also runs a business, State Farm agent Laura Feltner understands the work that it takes and would love to help lift some of the burden. This is protection you'll definitely want to look into.

Hazard! Look no further for small business insurance.

This small business insurance is not risky

Surprisingly Great Insurance

If you're looking for a business policy that can help cover buildings you own, computers, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

When you get a policy through the reliable name for small business insurance, your small business will thank you. Contact State Farm agent Laura Feltner's team today to explore the options that may be right for you.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

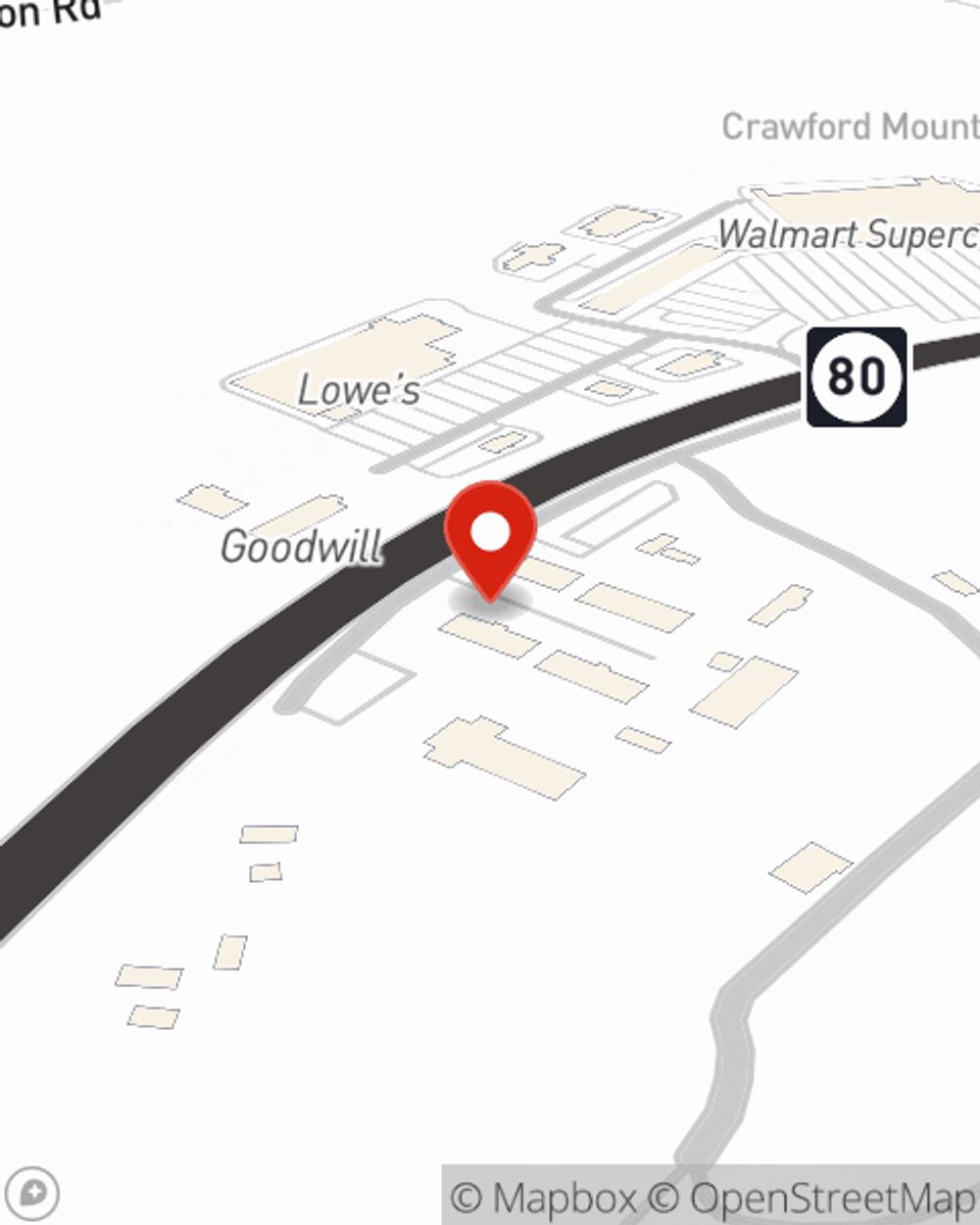

Laura Feltner

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.